Bitcoin On-Chain Activity Hits Historic Lows: Is the Bottom In?

By Newton Gitonga – May 12, 2024

In a week marred by continued volatility, Bitcoin, the leading cryptocurrency, has struggled to regain its footing, prompting questions among investors about the possibility of a market bottom. Despite a bullish rejection around $56,900 last week, optimism was short-lived as Bitcoin’s on-chain activity plunged to historic lows.

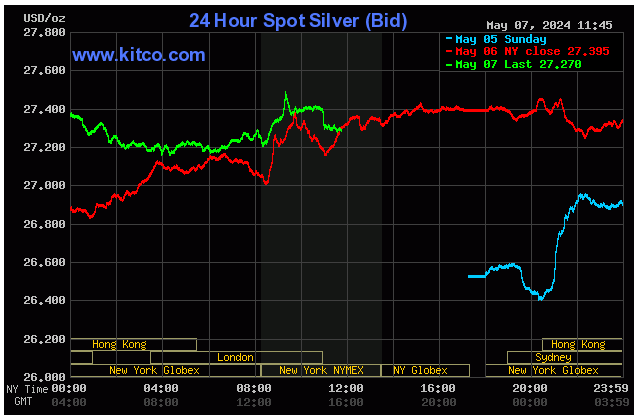

On Saturday, crypto analytics firm Santiment highlighted this development, emphasizing how Bitcoin’s on-chain activity has dwindled significantly in the two months since its all-time high, signaling widespread fear and indecision among traders.

“Bitcoin’s onchain activity is approaching historic lows as traders have dramatically slowed transactions… This isn’t necessarily a sign of more BTC dips, but rather a signal of crowd fear and indecision,” the firm wrote.

Further insights from a YouTube analysis by the firm’s analysts underscored concerns about the funding rate and a shortage of significant short positions, indicative of a prevailing fear in the market.

“Traders really don’t know what to do, they’re kind of sitting on their hands and waiting for a big move in one direction at this point,” remarked analysts, reflecting the widespread indecision gripping the cryptocurrency market.

Additionally, attention was drawn to the number of holders, which has flattened out historically. According to the analysts, while non-empty wallets are being created daily, this metric’s lack of significant growth during market flatness is seen as a sign of fear and indecision. They noted that they are closely monitoring this trend, particularly if the number of holders starts to decline, which could signal panic selling among traders and potentially foreshadow price rebounds.

Technically, popular markets analyst Maximillian noted that while Bitcoin experienced significant fluctuations, it is now approaching the $61,000 support level, which could either provide momentum for further declines or mark a potential turnaround point. In the short term, he emphasized the importance of overcoming the resistance level of $62,000 for sustained upward movement.

On Saturday, analyst Gareth Soloway pointed out that Bitcoin is consolidating within a parallel channel, a common occurrence following substantial price surges. Soloway highlighted two potential scenarios: a bear case and a bull case, depending on Bitcoin’s behavior within this channel.

In his bear case, Soloway cautioned that a downturn could be imminent if Bitcoin breaches the $57,500 support level and fails to recover swiftly. This could lead to a decline from $52,000 to $49,000, mainly if there’s a broader selloff in the stock market.

Conversely, in the bull case, Soloway emphasized the importance of Bitcoin maintaining its position within the parallel channel to sustain bullish momentum. He characterized the current consolidation phase as “bullish consolidation,” suggesting it sets a positive foundation for future price movements. If Bitcoin breaks above the upper boundary of the parallel channel, it could signal a continuation of the uptrend, potentially surpassing previous all-time highs.

Bitcoin was trading at $60,994 at press time, reflecting a 0.14% surge over the past 24 hours. According to CoinMarketCap data, the price has dropped by 3.50% over the past week.

DISCLAIMER: None Of The Information You Read On ZyCrypto Should Be Regarded As Investment Advice. Cryptocurrencies Are Highly Volatile, Conduct Your Own Research Before Making Any Investment Decisions.

The original article written by Newton Gitonga and posted on ZyCrypto.com.

Article reposted on Markethive by Jeffrey Sloe

** Loans, secure funding for business projects in the USA and around the world. Learn more about USA & International Financing at Commercial Funding International. **

Tim Moseley

.png)